As managing partner of The Gilroy Firm, Monica Gilroy Esq has over 24 years of experience practicing law. She received her Bachelor of Arts in Political Science from the University of Wisconsin in 1990 and a J.D. from the University of South Carolina School of Law in 1993. In addition, Ms. Gilroy attended the Ealing College of Higher Education in a study abroad program.

Ms. Gilroy began her legal career in a general practice, in which she honed her civil litigation trial skills. She transitioned to a position as an associate in a fiduciary law boutique, handling trust and estate litigation for major banks across the United States.

She came to McCalla, Raymer, Padrick, Cobb, Nichols and Clark, LLC in March 1999 and, working extensively in the litigation group for many of her current lending and real estate community clients, became a partner in 2004 and an equity partner in 2006, the youngest woman at McCalla Raymer to achieve this distinction. In April 2007, Dickenson Gilroy LLC was formed by Ms. Gilroy and attorney Jennifer L. Dickenson, with various attorneys and staff members of McCalla Raymer joining them.

At her current firm, Ms. Gilroy remains an active partner in the Litigation Department as the focus of her national litigation practice includes all aspects of real estate litigation, including property management issues, fair housing, foreclosure and title disputes, broker and agent liability defense, mortgage fraud-related litigation and civil and commercial contract disputes. She also leads the Default Department providing national foreclosure, bankruptcy, and loss mitigation and eviction services.

During her career, Ms. Gilroy has served as the litigation liaison for leading lending institutions as well as managed their national bankruptcy litigation program. She continues to serve as counsel for many national and local banks, mortgage companies and real estate industry lenders and leaders. She regularly assists closing attorneys, real estate agents, property managers, title companies and brokers when title or other contract issues arise. She practiced for several years in the areas of estate and trust litigation and serves regularly as a Special Master in Fulton County. Ms. Gilroy has extensive lead counsel trial experience and frequently appears in all of the state and federal courts of Georgia, including the state and federal appellate courts. She is also a member in good standing with the United States Supreme Court.

Ms. Gilroy had conducted hundreds of jury trials, bench trials, arbitrations and mediations and has regularly argues dispositive motions of all kinds.

Ms. Gilroy is the recent past Chair of the Real Property Law Section (“RPLS”) of the State Bar of Georgia, which is the largest section of the state bar with over 3500 members. In May 2015, Ms. Gilroy lead RPLS members in a three day education summit she solely coordinated. She previously served as the Editor of the RPLS Newsletter. She is a contributing writer to Foreclosure Law and Related Remedies: a State-by-State Digest which is published by the American Bar Association. She is a recent author through HarCourt Publishing on the affects of mortgage fraud in the lending industry.

She was appointed to the Education Committee of the National American Land Title Association (ALTA), a prestigious appointment with only 35 members being selected from the over 9,000 ALTA members. A long-standing member of the State Bar of Georgia on which she serves on the Education and Programs Committees, Ms. Gilroy enjoys membership with the Lawyers Club of Atlanta, the Georgia Women’s Lawyers Association, Georgia Mortgage Bankers Association, the Atlanta Board of Realtors and the Atlanta Volunteer Lawyers Foundation. She speaks and teaches on a regular basis at the state and national level to attorneys, real estate professionals, property managers, and real estate brokers and agents on litigation and real estate related topics.

Ms. Gilroy holds an AV-peer review rating with Martindale Hubbell. She is a peer nominated Georgia Super Lawyer for two years running in the practice area of real estate. Ms. Gilroy is a longtime volunteer for the Girl Scouts of Greater Atlanta, serving as a group leader and teen mentor, as well as a volunteer coordinator for the Fulton County Public School System.

She was appointed to the Education Committee of the National American Land Title Association (ALTA), a prestigious appointment with only 35 members being selected from the over 9,000 ALTA members. A long-standing member of the State Bar of Georgia on which she serves on the Education and Programs Committees, Ms. Gilroy enjoys membership with the Lawyers Club of Atlanta, the Georgia Women’s Lawyers Association, Georgia Mortgage Bankers Association, the Atlanta Board of Realtors and the Atlanta Volunteer Lawyers Foundation. She speaks and teaches on a regular basis at the state and national level to attorneys, real estate professionals, property managers, and real estate brokers and agents on litigation and real estate related topics.

Ms. Gilroy holds an AV-peer review rating with Martindale Hubbell. She is a peer nominated Georgia Super Lawyer for two years running in the practice area of real estate. Ms. Gilroy is a longtime volunteer for the Girl Scouts of Greater Atlanta, serving as a group leader and teen mentor, as well as a volunteer coordinator for the Fulton County Public School System.

Contact Monica

Contact Monica

Contact Our Recommended Vendors

As managing partner of The Gilroy Firm, Monica Gilroy Esq has over 24 years of experience practicing law. She received her Bachelor of Arts in Political Science from the University of Wisconsin in 1990 and a J.D. from the University of South Carolina School of Law in 1993. In addition, Ms. Gilroy attended the Ealing College of Higher Education in a study abroad program.

Ms. Gilroy began her legal career in a general practice, in which she honed her civil litigation trial skills. She transitioned to a position as an associate in a fiduciary law boutique, handling trust and estate litigation for major banks across the United States.

She came to McCalla, Raymer, Padrick, Cobb, Nichols and Clark, LLC in March 1999 and, working extensively in the litigation group for many of her current lending and real estate community clients, became a partner in 2004 and an equity partner in 2006, the youngest woman at McCalla Raymer to achieve this distinction. In April 2007, Dickenson Gilroy LLC was formed by Ms. Gilroy and attorney Jennifer L. Dickenson, with various attorneys and staff members of McCalla Raymer joining them.

At her current firm, Ms. Gilroy remains an active partner in the Litigation Department as the focus of her national litigation practice includes all aspects of real estate litigation, including property management issues, fair housing, foreclosure and title disputes, broker and agent liability defense, mortgage fraud-related litigation and civil and commercial contract disputes. She also leads the Default Department providing national foreclosure, bankruptcy, and loss mitigation and eviction services.

During her career, Ms. Gilroy has served as the litigation liaison for leading lending institutions as well as managed their national bankruptcy litigation program. She continues to serve as counsel for many national and local banks, mortgage companies and real estate industry lenders and leaders. She regularly assists closing attorneys, real estate agents, property managers, title companies and brokers when title or other contract issues arise. She practiced for several years in the areas of estate and trust litigation and serves regularly as a Special Master in Fulton County. Ms. Gilroy has extensive lead counsel trial experience and frequently appears in all of the state and federal courts of Georgia, including the state and federal appellate courts. She is also a member in good standing with the United States Supreme Court.

Ms. Gilroy had conducted hundreds of jury trials, bench trials, arbitrations and mediations and has regularly argues dispositive motions of all kinds.

Ms. Gilroy is the recent past Chair of the Real Property Law Section (“RPLS”) of the State Bar of Georgia, which is the largest section of the state bar with over 3500 members. In May 2015, Ms. Gilroy lead RPLS members in a three day education summit she solely coordinated. She previously served as the Editor of the RPLS Newsletter. She is a contributing writer to Foreclosure Law and Related Remedies: a State-by-State Digest which is published by the American Bar Association. She is a recent author through HarCourt Publishing on the affects of mortgage fraud in the lending industry.

She was appointed to the Education Committee of the National American Land Title Association (ALTA), a prestigious appointment with only 35 members being selected from the over 9,000 ALTA members. A long-standing member of the State Bar of Georgia on which she serves on the Education and Programs Committees, Ms. Gilroy enjoys membership with the Lawyers Club of Atlanta, the Georgia Women’s Lawyers Association, Georgia Mortgage Bankers Association, the Atlanta Board of Realtors and the Atlanta Volunteer Lawyers Foundation. She speaks and teaches on a regular basis at the state and national level to attorneys, real estate professionals, property managers, and real estate brokers and agents on litigation and real estate related topics.

Ms. Gilroy holds an AV-peer review rating with Martindale Hubbell. She is a peer nominated Georgia Super Lawyer for two years running in the practice area of real estate. Ms. Gilroy is a longtime volunteer for the Girl Scouts of Greater Atlanta, serving as a group leader and teen mentor, as well as a volunteer coordinator for the Fulton County Public School System.

Contact Monica

Contact Monica

Contact Our Recommended Vendors

National Service Charity might be the only national non-profit in existence without a cause.

Our cause is defined by the donor or volunteer. We supply the non-profit structure, counsel and organization. You provide the agenda.

The private sector is 100 times more able to help build the social welfare than the government. We just need leadership. That would be YOU. Your brilliant charity idea, plus our non-profit infrastructure, will brighten someone's day.

Mission Statement: we mobilize volunteers into community service using donor designated funds

we unleash the American can-do-spirit to solve local problems with local people and local dollars

Core Objectives:

- to give every donor the power to direct how and where their charitable assets are used

- to mobilize volunteers with funding and proven strategies of compassion

- to educate the volunteer industry through a database of community projects reviewed by donors and participants

- to enable corporations to build their brand and reputation with their community and customers

Broad Goals:

- to cultivate local donors who fund local projects which get accomplished by local volunteers

- to transform community service in America into a transparent industry

- to improve the social welfare by advancing community programs that cultivate self-reliance

- to infuse the political dialogue of volunteerism with conservative American ideals of limited government, personal responsibility, and compassion without codependency

- to showcase successful community service projects which are effective and sustainable

- to direct thankfulness away from the government and back toward local donors and local volunteers

Contact Our Recommended Vendor

Contact Our Recommended Vendors

View Our Expanding Line of Products

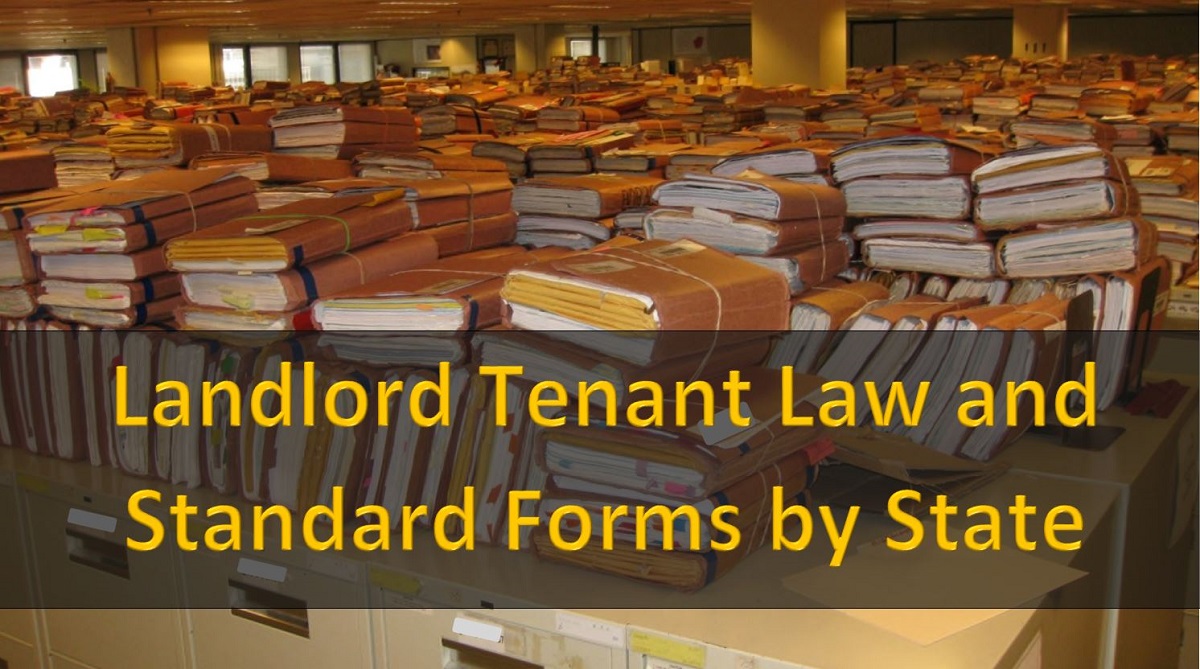

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.

When homebuilder Richard S. Jacobs spotted an unflattering online review of his metro Atlanta home-building firm, he first tried to have it removed, according to Gwinnett County court papers.

After Kudzu.com, an online review site owned by Atlanta-based Cox Enterprises, rebuffed him and refused to reveal the identity of the anonymous reviewer, Jacobs began sleuthing online for his critic.

He found her by tracking the handle she used in her online posts and then calling the businesses she had reviewed. Then he sued her for $1 million, claiming her post had defamed him and Georgian Fine Properties, causing sales to plummet, according to documents filed in Gwinnett County Superior Court.

On Friday, a Gwinnett County jury agreed with Jacobs that defendant Jill Knous had defamed him. But the jury, after a weeklong trial, rejected Jacobs' $1 million claim and request for more than $120,000 in legal fees, instead awarding $120,000 in damages and $12,000 in fees for three years of litigation.

Jacobs' attorney, Otto Feil of Atlanta's Taylor, Feil, Harper, Lumsden & Hess, was out of town and could not be reached for comment. But, at a pretrial hearing last year, Feil branded Knous' post as "a fake review" because Knous was not a Georgian Fine Properties customer, even though her anonymous review claimed that she was.

On Monday, Feil's co-counsel, Taylor Harper, said, "The fake review falsely claimed that [Knous] had purchased a home from the plaintiffs, had put down a nonrefundable deposit with the plaintiffs—all of which was asserted in order to give the reader the impression that there existed some factual basis for [Knous's] defamatory 'opinions,'" The review, he added, "implied that the plaintiffs engaged in some form of undisclosed wrongful actions involving her that were dishonest or corrupt."

As a result, he said, sales dropped "despite the upswing in the housing market" and only improved after Jacobs identified Knous and then sued her to take down the review. Kudzu was not named as a defendant in Jacobs' complaint.

Duane Morris attorney Cynthia Counts, who joined with James Johnson of Knight Johnson to defend Knous, said Knous is "considering all posttrial options, including the economic realities associated with an appeal."'

Counts contends that Knous' negative online post was her personal opinion and, as such, is constitutionally protected speech that should have shielded her from any defamation claim. Counts said Knous filed the review anonymously to protect her sister, who had worked for Georgian Fine Properties and had hired the company to renovate her own house "and to warn others about potential unclear contracts and bad customer service."

Count said Knous' sister had complained repeatedly to Knous about construction problems that Knous used as the basis for her Kudzu post. The review, Counts added, was also based on Knous' own observations of the workmanship about which her sister had complained.

The attorney also said two people who had direct dealings with Georgian Fine Properties testified at last week's trial that their experiences "were even worse" than those reflected in Knous's review, which they said was "certainly something they themselves could have posted."

Counts said that, if the jury's verdict stands, it could have "a chilling impact" on anyone who might consider posting a negative online review. "No question there is concern that allowing this type of case to go before a jury is problematic in that it effectively allows even well-intentioned juries to punish speech they disagree with," she said.

The case also apparently was problematic for Gwinnett County Superior Court Judge Timothy Hamil, who presided over the case until the Friday before trial. Hamil made clear in a court hearing last year that he had serious problems with the internet and with anonymous negative online reviews, in general, according to a transcript of the hearing. Last Friday, without explanation and without a request by the parties, he turned the case over to a senior judge, Howard Cook, who presided at Knous' trial after declining to reconsider Hamil's earlier refusal to dismiss the case on summary judgment.

At a March 2016 hearing, after Counts argued that Knous' review was protected speech, Hamil retorted, "That may be protected, but it's not moral. … That's the problem with our society and the internet is the anonymity of it all. In my opinion, the two worst inventions in the entire history of the world are cellphones and the internet. … The trolls of the world hide behind that anonymity."

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.

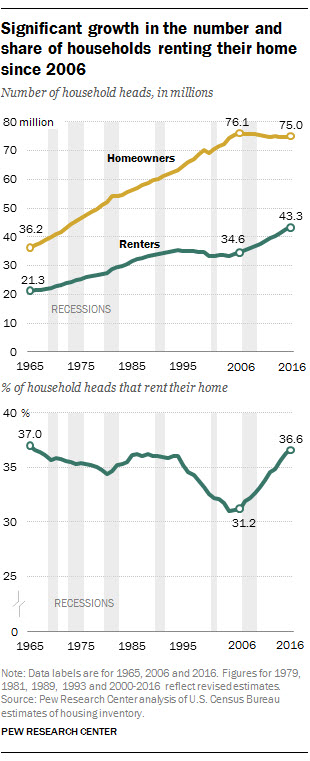

- More U.S. households are headed by renters than at any point since at least 1965.

- However, the top renter regret is not buying.

More people are renting than at any other point in the past 50 years.

In 2016, 36.6 percent of household heads rented their home, close to the 1965 number of 37 percent, according to a new report by the Pew Research Center based on data from the Census Bureau. Each month the Census Bureau surveys a nationally representative sample of households.

The total number of U.S. households grew by 7.6 million over the past decade, Pew reported. However, the number of households headed by owners remained relatively flat, while households headed by renters grew by nearly 10 percent during the same time period.

Rising home prices, lingering fears from the housing crash, and larger amounts of student debt are some of the reasons why many Americans see the appeal of renting, said Richard Fry, a senior researcher at Pew and one of the report's authors.

"There is some evidence that increased student debt has made it more difficult for households headed by young adults to become homeowners," Fry said.

And millennials (those age 35 and younger) continue to be the most likely of all age groups to rent, Pew found. In 2016, 65 percent of households headed by young adults were renting, up 8 percentage points from 2006.

Other reasons could be that young adults haven't accumulated enough wealth for a down payment on a house, Fry said. Also, owning a home inhibits moving, and young adults are the most likely age group to move, so they may prefer not to own just yet, he said.

Median sale price rises to highest on record

The happy homeowner

However, cautious renters may not be making the best decision for their long-term happiness. Renters' top regret was wishing they had bought instead of renting (41 percent), according to a recent Trulia survey.

"One thing our research has found is that people can sometimes be a little too cautious," said Trulia's managing editor, David Weidner. "In every U.S. major market, it's cheaper to buy a home than it is to rent over seven years. And it's really not even close."

Housing prices have been rising, with the median value of all homes in the U.S. in June surpassing $200,000, up 7 percent from a year ago. In the long run though, buying is still a better deal than renting, said Weidner.

People must realize that although a mortgage seems like a huge investment, your incomes are likely to rise, especially if you're a millennial, Weidner said, and over time the housing payment won't seem as big.

"The toughest times [after buying a house] is in those first few years. Down the road those costs will start to shrink as part of the overall home budget," Weidner said.

Almost half of Americans have buyer's remorse about their house. Although renting is today's trend, the future could look different. Nearly three-quarters (72 percent) of renters said they would like to buy a house at some point, according to a 2016 Pew survey.

Read this original story at http://www.cnbc.com/2017/07/20/there-are-more-renters-than-any-time-since-1965.html

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.

Thursday Luncheon -- August 17th, 2017

DoubleTree by Hilton Hotel Atlanta - Roswell

1075 Holcomb Bridge Road, Roswell,Georgia, 30076

TEL: +1-770-992-9600

FAX: +1-770-993-6539

About the Atlanta NAPRM Chapter

The National Association of Residential Property Managers (NARPM) is the nation's only professional organization specifically for those who manage residential properties. NARPM members demonstrate a high level of commitment to the field of residential property management by adhering to a Code of Ethics, enriching their industry knowledge and expertise through educational programs, and professional designations.

In 1991 a small group of residential property managers assembled at the Colony Square Hotel in Atlanta, Georgia to attend the first course ever offered by the fledgling National Association of Residential Property Managers (NARPM) which had been founded just three years earlier. The property maintenance course, taught by Rocky Maxwell, MPM, of H. M. S. Development, Inc., CRMC, in San Jose, California had only one Atlantan in the group – Robert Fowler, MPM.

Following the course, a reception was held during which a small group of Atlanta residential property managers assembled in the lounge of the hotel and agreed to form an Atlanta chapter of the new organization. Rob Fowler was subsequently elected to serve as President during the organizational period. The group met every other month and eventually reached the then required minimum membership of fifteen to become a Chapter in Formation (CIF). During these early years the chapter meetings were held in the lobby of the Courtyard Hotel, various Shoney’s and Steak and Ale restaurants around town.

In the spring of 1996, the year of the Centennial Olympics, Atlanta hosted the mid-year conference that was attended by about 80 property managers from around the nation. In preparation for the conference the Atlanta Chapter organized itself and became licensed by the Georgia Real Estate Commission as a school in order to offer continuing education in conjunction with its courses. The 1996 conference featured three national courses attended by 27 persons who received a combined total of 160 hours of continuing education. This was perhaps the first time anywhere in the nation that NARPM offered continuing education in conjunction with its courses. The meeting was also noteworthy due to the spring snowstorm that punctuated the event. The mid year event went so well that the national board of directors has approved the September, 2002, national convention to be held at Atlanta.

Early leaders of the Atlanta chapter include Dale Melhouse, Bonnie Garrett, Pat Bevis, Kim Tomlin, John Mangham, MPM, CPA, and Robert Fowler.

The Atlanta chapter has provided a vital positive influence at the national level of the organization where Robert Fowler served two terms as a member of the National Board of Directors, John Mangham served as an officer for four years, and national instructor for six years. Bill Ollinger, MPM, served as a national director and chaired the marketing committee and Tom Stokes, MPM, CPM®, currently serves a national director and chairs the Publications Committee.

Atlanta was named Chapter of the Year in 2000, and has received the Chapter of Excellence Award in the year 2000, 1999, and 1997.

The Atlanta NAPRM Chapter Mission

The NARPM Atlanta Chapter exists to promote education and professionalism in and for Residential Property Managers by recruiting and retaining new members and board members while continuing our tradition of offering excellent educational opportunities.

Upcoming Events

Social Event: Whirlyball Play and Net...

August- Board of Directors Meeting

October- Board of Directors Meeting

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.

Diana Alton’s living room table is stacked high with Santa Claus figurines and other Christmas decorations, but until about three years ago the holidays were no cause for her to celebrate.

Diana Alton’s living room table is stacked high with Santa Claus figurines and other Christmas decorations, but until about three years ago the holidays were no cause for her to celebrate.

That’s when her doctor told her to get a dog for emotional support. Alton, 65, still can’t work, but Scrappee Anne, her miniature schnauzer, makes it possible for her to socialize and cope with the anxieties of clinical depression and posttraumatic stress disorder.

“If it weren’t for Scrappee Anne, I don’t even know I would be talking with you today,” Alton said.

But Scrappee Anne also was the center of a three-year legal battle about “emotional support animals” that involved Alton, the federal government and her landlords, who required her to pay a $1,000 pet deposit for her Kelso apartment.

Alton’s case sets two rights in conflict – her right to cope with her medical condition and the landlords’ right to control and maintain their property. Alton is part of a growing trend of people with mental illnesses relying on what are known as therapy, comfort or “emotional support” animals to stem the symptoms of their illness. But the confusing patchwork of state and federal laws makes landlords and other businesses vulnerable to lawsuits if they impose restrictions.

Alton’s landlords, Linda and Bert Barber of Castle Rock, recently settled the case after incurring $175,000 in legal fees fighting Alton and the U.S. Department of House and Urban Development (HUD), which represented her. Early this month, they agreed to pay a $25,000 settlement to Alton and the government just to end it all.

“What happened to us is a warning to other landlords … and to brick and mortar stores,” Bert Barber said last week.

‘Ignorant of rights’

Alton moved into her apartment at 1632/1634 Minor Road in 2008. At least once, in 2009, Alton wrote to the Barbers about her wish to obtain a comfort/assistance animal to cope with her disabilities. She included a note from her doctor saying it would be helpful to her. In January 2011, Alton’s neighbor gave her Scrappee Anne to use as an assistance animal.

Bert Barber said last week that the dog had been a pet “and overnight it became a service animal.”

According to court documents, Alton testified that the property manager, Lori Thompson, told her Scrappee Anne did not qualify as a service animal and that Alton would have to pay a $1,000 pet deposit. Alton signed a pet agreement and began making $50 monthly payments toward the deposit.

It wasn’t until several months later that a caseworker with the Kelso Housing Authority told Alton, who was on federal housing assistance, that she shouldn’t have to pay the deposit.

Alton filed a complaint with HUD, which charged the Barbers with discrimination and referred the case to the U.S. Justice Department, which filed the case in U.S. District Court in Tacoma. HUD argued that the Barbers’ failure to waive the deposit violated Alton’s right for a reasonable accommodation for her disability under the federal Fair Housing Act.

The two parties disagree on several points about what followed. Linda Barber claims that Alton never requested a waiver of the pet deposit and would have received one if she had done so. Alton contends the Barbers retaliated by enforcing certain rules more strictly.

Alton moved out in May 2012 , saying she was becoming uncomfortable living there. She lost her federal housing assistance, but the Kelso Housing Authority found her a subsidized apartment near the Three Rivers Mall.

In October, U.S. District Court Judge Benjamin Settle found that “the government has failed to show a policy of discrimination” in the case. At the same time, he found “sufficient evidence of intimidation or threat” that lead to Alton to move out of the Barbers’ building. He denied both parties’ request for summary judgment and the case was set for trial on Nov. 19.

Bert Barber said he and his wife decided to settle the case not as admission of guilt but “as a business decision.” By this time, the Barbers and their insurance company had racked up $175,000 in legal fees, and Bert Barber said they couldn’t afford the risk of incurring more costs.

While the Barbers say they feel the government targeted them, Alton said it stood up for her rights.

“I think the problem is that people are ignorant of their rights,” Alton said.

Confusion

Federal and state laws regulate service and comfort animals differently, and that “confuses the landlords and the people renting,” said Sharon Ortiz, executive director of the Washington State Human Rights Commission.

Under state law, “service animals” are specially trained to perform a disability-related task, such as alerting people who are deaf, pulling a wheelchair, reminding a person to take medication or calming a person with PTSD. State law does not regulate how landlords must accommodate people with service animals, but it bars businesses and public entities from discriminating and turning away people with service animals (there is no specific license for such animals).

However, under pressure from the Washington Restaurant Association and other food-industry groups, the Legislature tweaked the law in 2011. It allowed restaurants, bars and grocery stores to prohibit all animals except for dogs and miniature horses that are trained as service animals.

Except for airlines, businesses and public entities do not have any legal obligation to permit comfort or emotional support animals that are not specially trained. Neither state law nor the federal Americans with Disability Act makes provisions for emotional support, comfort, therapy or companion animals that have no special training but can help their owners cope with mental illnesses.

“You can understand why the individual who has that animal for their PTSD would want it to accompany them out in the public, but the ADA doesn’t protect that privilege unless the animal has been trained,” said John Dineen of the Northwest ADA Center.

Once you step inside someone’s home, the rules change. The federal Fair Housing Act broadly defines “assistance animals” as any species, trained or untrained, that assists someone with a disability or mental illness. Under it, landlords must allow tenants to live with their assistance animals regardless of what their pet policies allow, but landlords can take any damages the animal cause out of the security deposit. Tenants also may request any fees or pet deposits to be waived as a reasonable accommodation for their disability. If the person’s disability is not apparent, a landlord may ask the tenant to provide medical documentation of the disability-related need for the animal.

The complexity of the rules leaves business owners confused about what to allow.

Dineen said that about 20 percent of the Northwest ADA Center come from landlords, business owners and people with disabilities confused about the laws involving service animals. The calls range from “a manager from a cafe in Oregon calling up and asking ‘is there really such a thing as a service squirrel?’” to a person with service animal complaining that a hotel wouldn’t allow them to book a room, he said.

Dana Millard, who owns the Pancake House in Longview, said she often has customers bring in emotional support animals into her restaurant. Other customers don’t say anything, but she wonders what they think.

“I love animals but I don’t think they have a place in restaurants unless they are serving a person’s (disability) need,” Millard said.

“I wouldn’t like seeing someone feeding the dog a piece of bacon and the dog is licking their finger and then they reach up to move the salt and pepper shaker,” Millard said. “We sanitize everything, but do other restaurants?”

Animal owners are responsible for cleaning up after their animal whether inside or outside the home, said Ortiz, the state Human Rights Commission director.

Alton said she has not encountered major problems with taking her dog into public places, restaurants and grocery stores. Many businesses and patients aren’t actually aware of the differences in state and federal law, and many don’t enforce the new tighter regulations.

Scrappee Anne is not a pet, but a critical aspect of her medical treatment, she argued, and asking her to pay pet deposit “would be like charging rent for a caretaker to come to my house.”

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.

This Month’s Training:

Question: How Do You Avoid Document Creep?

Managers too often make the mistake of loading up so much junk in their PMA's they end up with a 10 page document (with type size 8 to make it all fit). Prospective owner's croak on the overload. Our PMA has been 5 pages for the last 25 years. Here's how we do it.

Login to leave comments. Need to register? It's free!

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.

Brian Birdy is a national trainer with NARPM, a frequent speaker at local, state and national property management conferences, holds the CPM, RMP and MPM designation, is Vice President of Property Management, Inc and an instructor extraordinaire.

During his workshop in Savannah, Georgia June 2017 we took notes and got his permission to post them here for those who missed his very worthwhile presentation.

Below are the notes we personally took from Brian's Presentation

Lease Interviews

Stop doing face-to-face lease interviews. Nobody is listening. It takes too much time. It is cumbersome and tenants don't care. Consider using a lease interview video.

Let SPEED drive your business.

Use your property management software to the max. Tap into the company’s tech support and find someone locally who can help you.

Make sure your website is:

- ADA compliant

- SEO optimized

- Responsive

You have two seconds to capture their attention. Use the homepage to point them to information not give them information and keep it simple.

Embrace technology.

- Use electronic cash pay through service providers like Pay Near Me or Pay Lease.

- We don't want to see our tenants and we don't need to meet them so begin ‘auto showing’ your homes.

- Use inspection software or outsource inspections.

- Embrace maintenance software.

- Consider filter replacement options.

Memorandums are now defining the law.

Fair housing law started in 1967, however, HUD Memorandums are now making this much harder.

HUD is requiring that you evaluate each criminal conviction individually and make judgments on them. A safe method is simply just say any convictions for felonies within the last seven years are rejected. They must have been convicted not accused.

Pets

- Comfort Pets must be accepted if the applicant has legitimate back up. My best advice is treat them exactly as you would a child. Don't ask about shots or size.

- Emotional Support Animals can be any and all animals but Service Animals can only be a dog or small horse (and must be trained with specific skills needed to help the owner).

- Insurance companies are backing out of coverage if an owner or manager moves in an “aggressive breed” whether it is a service animal or comfort animal.

- HUD expects us to allow for reasonable accommodations.

- $300,000 judgment against a HOA for violating service animal rules. We can file a fair housing claim against the HOA.

- HUD hires testers to call you and ask trick questions to see if you are responding correctly.

Smoke Detectors

Just because a smoke detector beeps, doesn’t mean it works might not work. Beeping only means the battery works. Only detectors tested with smoke are reliable. Look for the date of expiration on the back.

Ten-year Lithium Tamper-Proof Smoke Detectors. Life span of current systems 8 to 10 years

Discrimination

LED equals Limited English Proficiency. It could be discriminatory not to have a lease in the language the tenant speaks depending on your market. Find people online to interpret for you. Think about sending a Spanish version of the lease for reading and an English version for signing.

Policy and Procedures

Have a policy and procedures manual that’s updated regularly. You don't have to start from scratch. It's not easy.

Upcoming Events

Register today for booth and hotel -- 2017 Annual NARPM Convention and Trade Show in Orlando, Florida October 18-20

Don't miss the 2018 Broker/Owner Retreat and Trade Fair April 9-11, 2018 in Las Vegas.

This has become one of NARPM’s most anticipated events for Designated Brokers, Company Owners, Regional Managers, and major decision makers.

Get the Late Fee Coupon as a PDF & Excel Doc

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.