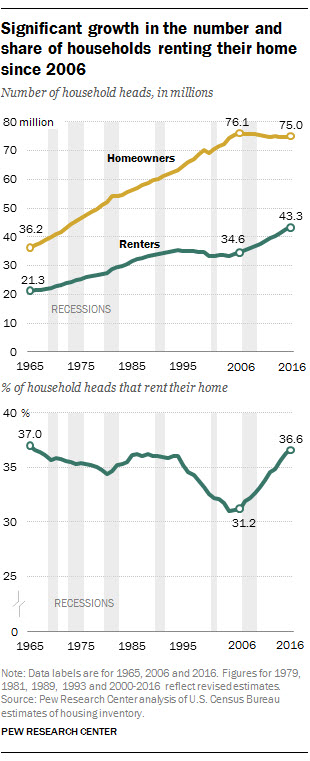

- More U.S. households are headed by renters than at any point since at least 1965.

- However, the top renter regret is not buying.

More people are renting than at any other point in the past 50 years.

In 2016, 36.6 percent of household heads rented their home, close to the 1965 number of 37 percent, according to a new report by the Pew Research Center based on data from the Census Bureau. Each month the Census Bureau surveys a nationally representative sample of households.

The total number of U.S. households grew by 7.6 million over the past decade, Pew reported. However, the number of households headed by owners remained relatively flat, while households headed by renters grew by nearly 10 percent during the same time period.

Rising home prices, lingering fears from the housing crash, and larger amounts of student debt are some of the reasons why many Americans see the appeal of renting, said Richard Fry, a senior researcher at Pew and one of the report's authors.

"There is some evidence that increased student debt has made it more difficult for households headed by young adults to become homeowners," Fry said.

And millennials (those age 35 and younger) continue to be the most likely of all age groups to rent, Pew found. In 2016, 65 percent of households headed by young adults were renting, up 8 percentage points from 2006.

Other reasons could be that young adults haven't accumulated enough wealth for a down payment on a house, Fry said. Also, owning a home inhibits moving, and young adults are the most likely age group to move, so they may prefer not to own just yet, he said.

Median sale price rises to highest on record

The happy homeowner

However, cautious renters may not be making the best decision for their long-term happiness. Renters' top regret was wishing they had bought instead of renting (41 percent), according to a recent Trulia survey.

"One thing our research has found is that people can sometimes be a little too cautious," said Trulia's managing editor, David Weidner. "In every U.S. major market, it's cheaper to buy a home than it is to rent over seven years. And it's really not even close."

Housing prices have been rising, with the median value of all homes in the U.S. in June surpassing $200,000, up 7 percent from a year ago. In the long run though, buying is still a better deal than renting, said Weidner.

People must realize that although a mortgage seems like a huge investment, your incomes are likely to rise, especially if you're a millennial, Weidner said, and over time the housing payment won't seem as big.

"The toughest times [after buying a house] is in those first few years. Down the road those costs will start to shrink as part of the overall home budget," Weidner said.

Almost half of Americans have buyer's remorse about their house. Although renting is today's trend, the future could look different. Nearly three-quarters (72 percent) of renters said they would like to buy a house at some point, according to a 2016 Pew survey.

Read this original story at http://www.cnbc.com/2017/07/20/there-are-more-renters-than-any-time-since-1965.html

View Our Expanding Line of Products

This is the part of our site where all the products, resources, videos, forms, manuals, handbooks, customized management agreements and leases, money-making ideas, CYA protections, checklists, service animal/comfort pet training and all you’ll ever need to run a safe and profitable management business. This is the “Mother Load”.

It will take us six to twelve months to get it all posted, and we’ll keep posting more as time goes on, but there will be more than you can digest before the end of the year. I’ve been digging through our 35 years of document archives and there’s more than I thought.

If you register we’ll send you notices as we post things so you’ll know what’s there and where to look for it.