Shop

-

Breakout (2)

-

Customized Lease Agreement (20)

-

Customized PMA (1)

-

CYA Owners (40)

-

CYA Tenant (33)

-

Document Packages (31)

-

Live Classes (9)

-

Member Freebies (8)

-

Membership (6)

-

Modules (17)

-

Newsletter Subscription (5)

-

Onboarding (4)

-

Pet (4)

-

Qualifying Guidelines (15)

-

Scope of Services (5)

-

Video Series (17)

| Image | Name | Summary | Price | Buy |

|---|---|---|---|---|

| Modules 1,2,3,4,5,6,7,8,9 Property Management Agreement |

The documents on this site are the result of a 25-year collaboration between national trainer Robert Locke RMP, MPM and trial attorney Monica Gilroy as Crown Management navigated its way through the legal challenges of managing rentals in Atlanta. Monica’s expertise in real estate litigation (especially landlord/tenant and fair housing disputes) uniquely equipped her to write great property management agreements (PMA) that managers have been downloading and embracing for years. Over 65 managers (in 17 states) now use these documents and benefit from the experience of Robert and Monica. The management agreement is the cornerstone of your business as it establishes your management style, lease format, Scope of Service, owner handbook, how safely you’ll operate and how much money you’ll make. It will drive every policy and process you operate by. A properly written PMA will protect you from the hazards of the business and make you scalable and profitable. A poorly written PMA will expose you to risks and prevent you from being scalable and from making the kind of money you should make. Have a customized agreement and you’ll get control of your business, find it simpler to run, have less conflict (litigation) and turn it into a money machine. Starting with our document (or yours) we’ll help you craft a PMA exactly as it should be with all the CYA protections and revenue-generating strategies you need to become a successful and prosperous manager. We’ll help you shape the agreement to your model and state laws. We don’t leave you alone in this project but partner with you to have a document just as you want to operate and hand hold you through the entire process. We’ve been offering this document online for several years and over 100 managers (in 17 states) have adopted it. This is much more than just the document. This is 35 years of experience wrapped up in documents (plus training videos) including all the proper disclosures to turn on the revenue streams and turn property management into a Cash Cow, CYA protections and things you didn’t even know you needed (and won’t even think about) until it’s too late. We have spent tens of thousands of dollars with our lawyer over the last three decades perfecting and revising these documents. They have prevented countless lawsuits and disputes with owners and have made us tons of money (literally millions). You will too if you acquire these documents and put them to work in your business. Or, learn from your own experiences over the next 25 years, make your own mistakes and create your own war stories and documents. The choice is yours. Our document was originally drafted in the mid 90’s by a large prominent real estate litigation firm in Atlanta, Georgia and attorney Monica Gilroy (a landlord/tenant litigator) has been tweaking, editing, updating, revising, and perfecting it for us ever since. Revisions have been driven by the ever changing license law, landlord tenant law, federal and state law and our experiences with over 9,000 tenants. It is undoubtedly the best CYA management agreement you could ever use and full of revenue-generating strategies. What you get:

You’re not alone in this effort. Our mission is to help you customize this document (or help you tweak yours) to work in your model and in compliance with your state laws. We’ll collaborate with you to make sure it’s exactly what you need to be scalable and profitable in your market. Think of this as what you might earn leasing two properties. Clients tell us they make up this cost in the first month or two of use because of the revenue streams they discover in the training. Literally this will MAKE YOU MONEY … NOT COST YOU MONEY. | $2,500.00 | ||

| Monthly Consulting (with documents) | Many managers ask for the big document packages PLUS the full consulting program. This full consulting with document packages includes all the primary document packages, the video libraries that come with them and monthly consulting meetings with our staff and attorney Monica Gilroy. It’s the most comprehensive package we offer and will literally take your company to the next level. Document packages are delivered throughout the term as we attack the topic. The program includes $5,500 worth of document packages. Over 60 clients have engaged with this program in the past two years. Select from a 3-Month, 6-Month or 12-Month Agreement. | From: $500.00 / month for 12 months | ||

| Lease Module # 1 Customized Rental Agreement | For 20 years attorney Monica Gilroy pushed us to keep the rental agreement short (like eight pages) because long documents are hard to defend in court. Some managers think they should have a 10-page lease (type size 8 to fit it all in) plus attach the application and exhibits, addendums, and incorporate the tenant handbook, the move in inspection and company policies into the original document making defending it quite impossible. There are, however, some critical topics we need to address in detail to set expectations and protect yourself from tenant-driven lawsuits. These stand alone (Housekeeping) documents should be included with all leases to explain HOW you’re going to manage specific situations. Occasionally the home has special characteristics like a hot tub, an HOA community, roommates, or a co-signer and you’ll want a special document (Ancillary Documents) to address these unique situations as needed. | $1,495.00 | ||

| PMA Module # 1 |

The documents on this site are the result of a 25-year collaboration between national trainer Robert Locke RMP, MPM and trial attorney Monica Gilroy as Crown Management navigated its way through the legal challenges of managing rentals in Atlanta. Monica’s expertise in real estate litigation (especially landlord/tenant and fair housing disputes) uniquely equipped her to write great property management agreements (PMA) that managers have been downloading and embracing for years. Over 65 managers (in 17 states) now use these documents and benefit from the experience of Robert and Monica. What you get in Module #1

Because of their extensive experience in the business, this customized PMA (with instructor notes) is sufficient for many veteran managers. For others we also make available Module #2; a library of training videos on the PMA to help you strengthen your understanding of how to build a profitable management agreement. We go into detail regarding most stipulations in the agreement and explain why they are important. These videos address only owner (management agreement) issues and follow (and expands on) the customized PMA training notes in Module #1. See Module #2 https://trainingpropertymanagers.com/pma for more information. You’re not alone in this effort. Our mission is to help you customize this document to work in your model. We’ll collaborate with you to make sure it’s exactly what you need to be scalable and profitable in your market. These documents have been tweaked and perfected by attorney Monica Gilroy and veteran Robert Locke RMP, MPM and are usable in all states. Always run legal documents by your local attorney before you use them.Video Training Example | $895.00 | ||

| PMA Module # 2 (Housekeeping, Ancillary, Entity Documents) | For 20 years attorney Monica Gilroy and national trainer Robert Locke RMP, MPM have been developing state specific customized HouseKeeping documents for Crown and other managers who were interested. Over the years we have figured out there are some things you need to address in stand-alone documents (separate from the PMA) because they need special attention. Things like mold disclosures, foreclosure disclosures, personal property disclosures, agency disclosures and maintenance processes are examples. Sometimes, when a big topic is addressed in the management agreement, it stretches the document into 10 or 12 pages which is too long. Some management agreements go on for 14+ pages (using type size 8 to fit it all in) and are overwhelming owners and arduous for us to manage. Long agreements generate too much information (and suspicion) for the owner. A better strategy is to remove some topics from the management agreement and put them on separate pages the owner signs but you don’t (Housekeeping Documents). Occasionally the home has special characteristics like a hot tub, it’s in a HOA community or has a commercial home warranty and you’ll want a special document to address these unique situations (Ancillary Documents). Occasionally the property will be held in a state-sanctioned entity like a Land Trust, LLC or Corporation and you’ll need an affidavit to pin down the owner hiding behind the curtain so you make sure you’re dealing with the right person (Entity Documents). All of these documents are critical to your protection, will prevent litigation and generate more revenue. | $595.00 | ||

| SIX Months Consulting (with documents) | Many managers ask for the big document packages PLUS the full consulting program. This full consulting with document packages includes all the primary document packages, the video libraries that come with them and monthly consulting meetings with our staff and attorney Monica Gilroy. We will literally take your company to the next level. This package includes the full customized PMA and Lease document packages. That’s a $4,000 value at no additional charge. Over 60 clients have engaged with this program in the past two years. | $500.00 / month for 6 months | ||

| PMA Package #2: Housekeeping Documents |

For 20 years attorney Monica has pushed her clients into keeping the management agreement short (like six pages) because long documents are hard to defend in court. Some managers think they should have a 10-page PMA plus exhibits, addendums, and incorporate the owner handbook (and company policies) into the original document which makes defending it quite impossible. There are, however, some critical topics addressed in the PMA you need to expand on in more detail to set expectations and protect ourselves from owner-driven lawsuits. These stand alone (housekeeping) documents are listed below. If you address wormey topic in the management agreement, it can stretch the document to 10 or 12 pages which is way too long. Some management agreements go on for 14+ pages, incorporate owner handbooks, lots of operational manuita and can overwhelm the owner. Long agreements generate too much information (and suspicion) for the owner. A better strategy is to remove some of the manuita from the management agreement and put them on separate pages the owner signs (but not you) and we call them housekeeping documents. These are CYA documents designed to protect you from the litigation coming your way. They add body armor to your business and keep you from getting sued. Protect yourself from lawsuits, without loading up your PMA with all the operational manuita, by adopting these housekeeping, documents. What you get:

You’re not alone in this effort. Our mission is to help you customize these documents to work in your model. We’ll collaborate with you to make sure it’s exactly what you need to be scalable and profitable in your market. | $495.00 | ||

| Onboarding Module # 3 Super Package | Includes Module # 1 / Module # 2Module # 1 Ten Video Library on the Process of Onboarding Module # 2 These documents address the pain points (things the owner worries and frets about). Explaining how you do certain tasks calms their nerves and solidifies what the PMA tells them. Items a through d below expands your Scope of Service which the others (e through l) describe how you handle other tasks. Send these out in a drip campaign during the first 90 days after the first move in and to ALL owners the first 90 days of every year. You’ll quite owner’s fears of the unknown (pain points) and protect yourself when they claim “you never disclosed that to them.” Included Documents: New Owner Prospect Tracking, Summary of Leasing and Management Services working copy and sample (the new owner presentation), Documents for your drip campaign after you’ve leased the property, Things You Can’t Turn Over to Your Property Manager, Managing the Owner’s Third-Party Relationships – Newsletter and Training, Asset Manager vs Property Manager, The Property Manager’s Job Description, How We Handle Maintenance, How We Manage Emergency Maintenance, How We Handle Rent Collection and Evictions, How We Qualify Applicants, How We Handle Renewals, How We Handle Lease Defaults, How We Manage Move Outs, How We Manage the Separation. Included Videos: All 10 training videos in Module #1 | Original price was: $592.00.$495.00Current price is: $495.00. | ||

| Onboarding Module # 2 | These documents address the pain points (things the owner worries and frets about). Explaining how you do certain tasks calms their nerves and solidifies what the PMA tells them. Items a through d below expands your Scope of Service which the others (e through l) describe how you handle other tasks. Send these out in a drip campaign during the first 90 days after the first move in and to ALL owners the first 90 days of every year. You’ll quite owner’s fears of the unknown (pain points) and protect yourself when they claim “you never disclosed that to them.” Included Documents: New Owner Prospect Tracking, Summary of Leasing and Management Services working copy and sample (the new owner presentation), Documents for your drip campaign after you’ve leased the property, Things You Can’t Turn Over to Your Property Manager, Managing the Owner’s Third-Party Relationships – Newsletter and Training, Asset Manager vs Property Manager, The Property Manager’s Job Description, How We Handle Maintenance, How We Manage Emergency Maintenance, How We Handle Rent Collection and Evictions, How We Qualify Applicants, How We Handle Renewals, How We Handle Lease Defaults, How We Manage Move Outs, How We Manage the Separation | $477.00 | ||

| Lease Module # 2 Housekeeping & Ancillary Docs/Vids | For 20 years attorney Monica Gilroy pushed us to keep the rental agreement short (like eight pages) because long documents are hard to defend in court. Some managers think they should have a 10-page lease (type size 8 to fit it all in) plus attach the application and exhibits, addendums, and incorporate the tenant handbook, the move in inspection and company policies into the original document making defending it quite impossible.There are, however, some critical topics we need to address in detail to set expectations and protect yourself from tenant-driven lawsuits. These stand alone (Housekeeping) documents should be included with all leases to explain HOW you’re going to manage specific situations. Occasionally the home has special characteristics like a hot tub, an HOA community, roommates, or a co-signer and you’ll want a special document (Ancillary Documents) to address these unique situations as needed. | $395.00 | ||

| Policies & Procedures for Qualifying Applicants | Everyone knows managers must strive for objectivity when approving and denying applicants but few have wrestled through the process of putting it in writing. One mistake when pulling personal information, passing it around, viewing it, scanning/copying to the wrong person and storing customer’s private information can ruin a property manager’s career. Over the years we developed the details of how to treat all applicants the same to reduce the chances of a claim of discrimination. We call it Qualifying Guidelines and it is available to our students along with several other tools to qualify applicants objectively and safely. In 35 years (processing over 20,000 applications) we never had a fair housing claim as we consistently applied these written guidelines to all applicants, the same way, every time. These qualifying guidelines are the result of 35 years of perfecting the process. Bought separately the price totals $476.00. Bought as a Package (items 1,2,3,4) it’s $ 395.00 | Original price was: $476.00.$395.00Current price is: $395.00. | ||

| The Full Qualifying Guidelines Document | This is a 25 page manual we developed over 35 years that guided us through a Law-Suit-Free Experience in processing our applicants. This manual guided our managers to treat all applicants properly as it related to credit scores, secondary income streams, no employment situations, retired applicant's, child support, no green card applicants, foreign nationals, disabled, roommates, recent foreclosures, special needs occupants, spouses with bankruptcies and more. The document is full of training notes and can be used for training your staff. | $375.00 | ||

| Monthly Coaching | Many of our clients aren’t satisfied with the $27/mo Subscriber connection to our site and want a more direct and meaningful relationship. We’ve responded to this demand by creating a property management coaching category where we meet monthly to address specific topics that are identified by the customer. Customers list their Topics of Interest and we talk through them along with document packages that we bring to the conversation, discounts and special access to things on our site. You’ll receive lots of meaningful coaching plus AVAILABILITY to Robert and staff for answers to urgent questions as situations arise that need immediate solutions. | $350.00 / month | ||

| CYA from Tenants Package # 4 |

All the Resident Sign Up Documents (Packages 1-3) which includes documents 1-24. The price for buying each document individually would total $400.00, or you can purchase the complete package for $295.00 . | $295.00 | ||

| CYA from Owners Package # 4 (Docs 1-21) | Buy Package #4: All the New Owner Sign-Up Documents (Packages 1-3) which includes documents 1-21. The price for buying each document individually would total $360.00, or you can purchase the complete package for $285.00 (Subscribers get another 20% off all Document Packages). We spent thousands of dollars developing these documents. You can have them for pennies on the dollar. Package # 1, Package # 2, Package # 3 | $285.00 | ||

| Ongoing Consulting | Several of our clients have asked, “how can we keep a relationship with Robert and Training Property Managers after a 12 month consulting experience?” In response we’ve developed a continuation program. During this time we can cover any topic and still implement new revenue steams as requested. | $250.00 / month | ||

| Document Assessment | Several clients have asked us to evaluate their current management agreement (and/or Lease) and give them an assessment of its viability (scalability, profitability and safety) so we developed a Document Assessment Program where we take your agreement(s), evaluate it and send you a Report of Findings. (We actually mark up your document like your teacher in high school did and return it for our conversation.) This service comes with an hour of one-on-one consulting time to discuss what we found and make suggestions as to what you might do to tweak or revise your document. The cost is $200 for each document (total $400 for both) and we need a week to do the assessment. You pay $200 now and the balance when we’re done (if you send us both documents). Simply hit the shopping cart, make the $200 payment and scan us the document(s) you want us to evaluate. You’ll get further instructions by email after this payment is received. The cost is $200 and we need a week to do the assessment. | $200.00 | ||

| CYA Owner Housekeeping Documents Package B |

Buy Package #2: Customized PMA Housekeeping Documents (attach to all PMAs) which includes documents 1-12. The price for buying each document individually would total $435.00 or you can purchase the complete package for $297.00. We spent thousands of dollars developing these documents. You can have them for pennies on the dollar. 1. Mold / Mildew / Moisture Disclosure; 2. Establishing & Maintaining the Trust Account; 3. Personal Property Disclosure; 4. Owner’s Mortgage Disclosure; 5. W-9 Form; 6. Lead Paint and Flood Disclosure; 7. Authorization to Add Agent (property manager) as an Additional Insured.; 8. Personal Property Feature Disclaimer; 9. Authorization for Automatic Funds Transfer; 10. Owner Declaration and Data Schedule; 11. Unenforceable Terms in the Lease Disclosure; 12. New Property/Owner Sign Up Checklist plus you receive 71 minutes of training videos covering every detail of these documents.We have dozens of detailed videos on each part of this product. Click to view. This product can be yours FOR FREE under the 12 Month Consulting Agreement. Click to View | $195.00 | ||

| Scope of Service | This is the longer version describing the limits of duties, tasks and responsibilities as their manager. This document evolved over 20 years as our way of answering the owner’s question “what am I paying you for anyway?” It lays out what we do for the procurement fee, renewal fee and monthly management fee. It’s detailed and won’t be exactly as you do it so you’ll have to tweak it to fit your model. | $177.00 | ||

| Cashing in On PM Video Series | In this series of videos we detail how to ‘turn a nickel-dime businesses into a money machine’ by generate revenue from residents, owners, and vendors without losing anyone. We’ll address the contractual issues, policy issues, and challenge of implementation of new fees and charges. We’ll address the ethical issues of who you disclose to, what you disclose, and when to disclose fees and charges. This series is all about making property management profitable. | $149.00 | ||

| The Property Manager’s Job Description (Scope of Services) | We have job descriptions for everyone in our office, but not one for ourselves, as it relates to what we do for the owner. This is a visual way of describing to owners exactly what they retain control of, what the manager takes over, and what you’ll work on together. We developed it in the mid 90’s and gave it to all owners, once a year, to remind them what we do for our fee we charge and what they retain control of. As always, it’s not locked down. You get to tweak it to match your model and create your job description as you want it to be. This document evolves over time as your model changes. It reduces the tension between you and the owner and answers questions before they are asked. | $127.00 | ||

| CYA from Owners Package # 1 |

Buy Package #1: New Owner Sign-Up Housekeeping Documents (attach to all PMAs) which includes documents 1-9. The price for buying each document individually would total $150.00 or you can purchase the complete package for $125.00 (Subscribers get another 20% off all Document Packages). We spent thousands of dollars developing these documents. You can have them for pennies on the dollar. 1. Owner’s Homeowner Association Disclosure; 2. Mold / Mildew / Moisture Disclosure; 3. Establishing & Maintaining the Trust Account; 4. Personal Property Disclosure; 5. Owner’s Mortgage Disclosure; 6. W-9 Form; 7. Lead Paint and Flood Disclosure; 8. Authorization to Add Agent (property manager) as an Additional Insured.; 9. Personal Property Feature Disclaimer | $125.00 | ||

| Qualifying Guideline Supplemental Document Package | Bought separately the total is $149.00. Downloaded as a package the price changes to $120.00 (and subscribers get another 20% off the price of $120). | $120.00 | ||

| Cashing in On Property Management | In this class we learn how to ‘turn a nickel-dime businesses into a money machine’ by generate revenue from residents, owners, and vendors without losing anyone. We’ll address the contractual issues, policy issues, and challenge of implementation of new fees and charges. We’ll address the ethical issues of who you disclose to, what you disclose, and when to disclose fees and charges. This class is all about making property management profitable. | $119.00 | ||

| Onboarding New Owners | For most property managers the onboarding process is haphazard, by the seat-of-the-pants and thrown together without much forethought. New managers (and veterans alike) have so many things to figure out that a great onboarding process gets pushed to the back of the to-do list to “someday we’ll figure it out” and, in the meantime, they miss out on lots of new owners. This onboarding process needs to be a high priority because we all lose owners every month and need to grow our numbers. The question is, “what does a great onboarding process look like and how can I get there quickly?” One of the things we did really well at Crown was bring new owners onboard. During our last 8 years in business we signed up 16 to 25 new owners a month and had a well oiled process to make this happen. We’ve put together a complete package of onboarding documents, processes and training (plus a full library of training videos) to help managers build this all important segment of their business. | Original price was: $157.00.$115.00Current price is: $115.00. | ||

| CYA from Owners Package # 2 | Buy Package #2: New Owner Sign-Up Ancillary Documents (use them when appropriate) which includes documents 10-18. The price for buying each document individually would total $120.00 or you can purchase the complete package for $100.00 (Subscribers get another 20% off all Document Packages). We spent thousands of dollars developing these documents. You can have them for pennies on the dollar. 10. Limiting Smoking in the Lease; 11. Assessing the Habitability; 12. Things You Can’t Turn Over to Your Property Manager; 13. Power of Attorney; 14. Investor Management Agreement Addendum; 15. Hot Tub Exhibit to Management Agreement & Policy Statement; 16. Adding a Property to an Existing Management Agreement; 17. New Property/Owner Sign Up Checklist; 18. Special Pricing & Guarantees | $100.00 | ||

| Things You Never Put in Your Agreements | 12 Video Series — There is no doubt that managers need experience before crafting their management agreements. There are issues of liability and revenue which must be addressed in the management agreement, or the business will suffer. In this twelve video series we address the primary issues, with examples, and lay out a plan for a well written document. | $97.00 | ||

| Building a Killer Lease Agreement | 3 HOURS of Video Training — After reading dozens of lease agreements as a consultant I’ve figured out that although managers do this business very differently. Many managers copy and paste from other’s agreements without realizing they’re not in conformity with the state laws. Agents often adopt their realtor association documents and don’t realize the limitations of the language in those agreements. In this class we cover the primary issues you must address when crafting a Lease Agreement. | $97.00 | ||

| Building a Killer Management Agreement | 3 HOURS of Video Training — After reading dozens of management agreements as a consultant I’ve figured out that although managers do this business very differently, there are common stipulations that belong in every property management agreement regardless of your management model or state regulations. Managers constantly add language that shouldn’t be there, language that complicates their processes, prevents them from being scalable and exposes them to unwanted litigation. Managers often copy and paste from other’s agreements without realizing they’re handcuffing themselves to archaic language that only hinders them from being profitable and scalable as a management company. Agents often adopt their realtor association standardized agreement and don’t realize the limitations of the language in those agreements. Others just keep adding more and more stipulations in hopes of managing through their document instead of giving themselves the freedom they need to maximize profits and protect themselves. | $97.00 | ||

| The Short Qualifying Guidelines Document | Some won’t (or don’t want to) spend the money to get all the tools and training in this manual so we’re offering a shrunk-down version. If you want a basic framework for setting qualifying guidelines, a place to start, this shorter version of the full manual will give you a leg-up on the process. With this document you’ll be able to develop your own set of guidelines over time. This document (and training notes) will lay out what each credit score will require for approval, plus a chart laying out who should be managing the process for each category of applicant. You can use this do-it-yourself version and work through your own learning curves over time. | $97.00 | ||

| PMA Module # 5 Entity Documents |

Owners often attempt to camouflage who the real owner is and create curtains to hide behind. To prevent themselves from being named in lawsuits they often hold title in a Limited Liability Company, land trust or family limited partnership making it hard for the public (and the property manager) to figure out how they should be receiving the money and who is making management decisions. Who signs the PMA isn’t always as simple as it looks when there is an entity involved. What you get in Module #5

These CYA documents are critical to your survival when managing for entities. Do your due diligence, have them execute the appropriate documents and protect yourself. These documents have been crafted by attorney Monica Gilroy and are usable in all states. Always run legal documents by your local attorney before you use them. | $95.00 | ||

| CYA Ancillary Documents Package C | Buy Package #3: Ancillary Documents Package # 3 (Items 1-10) (use them when appropriate) which includes documents 1-10. The price for buying each document individually would total $134.00 or you can purchase the complete package for $95.00 We spent thousands of dollars developing these documents. You can have them for pennies on the dollar. 1. HOA Disclosure; 2. Power of Attorney & Power of Attorney SAMPLE; 3. Modification of Agreement; 4. Adding a Property to an Existing Management Agreement; 5. Multiple Owner Declaration and Data Schedule Exhibit; 6. Entity Declaration and Data Schedule Exhibit; 7. Home Warranty Disclosure and Agreement plus you receive 26 minutes of training videos covering every detail of these documents.We have dozens of detailed videos on each part of this product. Click to view. This product can be yours FOR FREE under the 12 Month Consulting Agreement. Click to View | $95.00 | ||

| CYA from Tenants Package # 2 |

Resident Sign Up Housekeeping (make these a part of your lease packet) which includes ten documents. The price for buying each document individually would total $153.00, or you can purchase the complete package for $95.00. Documents Included in this Package: 1. Pet Exhibit; 2. Resident’s Maintenance Agreement; 3. Homeowner Association Agreement; 4. Landlord vs Resident’s Responsibilities Maintenance Chart; 5. Lead Paint and Flood Disclosure; 6. Mold, Mildew, Moisture Disclosure; 7. Mold Information and Prevention; 8. Smoke Detector Release and Renters Insurance Disclosure; 9. Utility Agreement and Property Visit); 10. Move-In Checklist and Report Card | Original price was: $153.00.$95.00Current price is: $95.00. | ||

| Rules for Engaging the Owner in the Qualifying Process |

Property managers often collaborate with the owner on approving and denying applications and need to make sure they don’t violate the tenant’s rights of privacy, or the Fair Credit Reporting Act, when doing so. Owners often bully new managers into thinking that they, the owner, require the tenant’s information so they can make a fully informed approval or denial decision. It is quite natural for owners to think they are in control and if the manager caves in and passes the tenants information to the owner, they could find themselves in serious trouble with the law. Owners are not accustomed to hearing real estate agents tell them “no” and often push hard to get the tenant’s information and remain in control. If you want to keep your license, keep from having a claim from the Federal Trade Commission (the enforcers of the Fair Credit Reporting Act) and spend lots of money in attorney fees defending yourself, you’ll learn to tactfully refuse the owner and do the job they hired you for, which includes keeping them out of trouble with the law. No matter what your model, there are some important rules you must follow when presenting applications to the owner. There is certain information you should never share with the owner under any conditions and some things you don’t want to miss passing over to them. Knowing the difference is the topic of this package. We’ll answer the question what’s the safe way to satisfy the owner’s appetite for information, without exposing yourself (and them) to violations of the Fair Credit Reporting Act, HUD, Americans with Disabilities Act, Servicemembers Civil Relief Act and a host of other laws that govern the handling of the applicant’s personal information. | $87.00 | ||

| CYA from Tenants Package # 3 |

Resident Sign Up Ancillary Documents (use these as needed) which includes nine documents. The price for buying each document individually would total $141.00, or you can purchase the complete package for $87.00. Documents Included in this Package: 1. Roommate Agreement; 2. Hot Tub Exhibit to Lease; 3. Personal Property Schedule; 4. Move me in even though the property is not ready; 5. Military Exhibit; 6. Guarantee of Payment (Cosigner Agreement); 7. Security System Disclaimer; 8. Security Deposit Promissory Note; 9. Audit Checklist | Original price was: $141.00.$87.00Current price is: $87.00. | ||

| Asset Manager vs Property Manager | Some owners think you should manage everything that remotely touches their property. Most have never owned a rental property and have no idea what property managers do. If you don’t manage their expectations they will instinctively ask you to manage mortgage issues, utilities, home warranties, set up bank accounts, file foreign tax compliance forms, manage HOA issues, insurance claims and whatever else needs to be done, in addition to managing the tenant and maintenance. That’s a perfect definition of an asset manager but most owners don’t know the difference and neither do most property managers. Often, large asset managers (or foreign investors) will ask you to set budgets, estimate NOI, get bids on insurance coverages, manage the code enforcement officer, manage property tax disputes, oversee insurance claims and a whole host of other duties you’re not trained to (or have the experience to) manage. To make it worse, you’re not being paid to do all that stuff for the lousy $70 a month management fee. Private owners sometimes have the same ideas and need help understanding what you do for the fees they pay you or, better yet, what you don’t do. If you don’t define it, they will, and often their expectations are off the chart and totally unacceptable. If you don’t have a way to explain the limits of your services there will be tension between you and your client as you attempt to quell their unrealistic expectations as they come up. Defining the difference between an asset manager and a property manager is a great way to address the issue. Managers need a document to send their owners (or make it part of their new owner sign up package) that identifies the differences. Over the years we developed a document differentiating one from the other so the owner can get their heads around what you do and don’t do for your fees. It’s a editable document so you can add your company name, tweak it to your model and publish it. | $85.00 | ||

| Managing Litigation in Property Management | Property Management is the least paying job within the real estate industry, but the job where you are most likely to get sued. Even lawyers stay clear of our industry because there is so much work for them with so little reward. Robert Locke in Orlando offered the national NARPM conference a proven set of strategies for limiting litigation. The event was taken and reworked within the studio for those who could not be at the event. This video series will resource your employees and office leadership to create policies and set procedures to mitigate litigation which is robbing your company of the joy and profits which are possible in property management. | $77.00 | ||

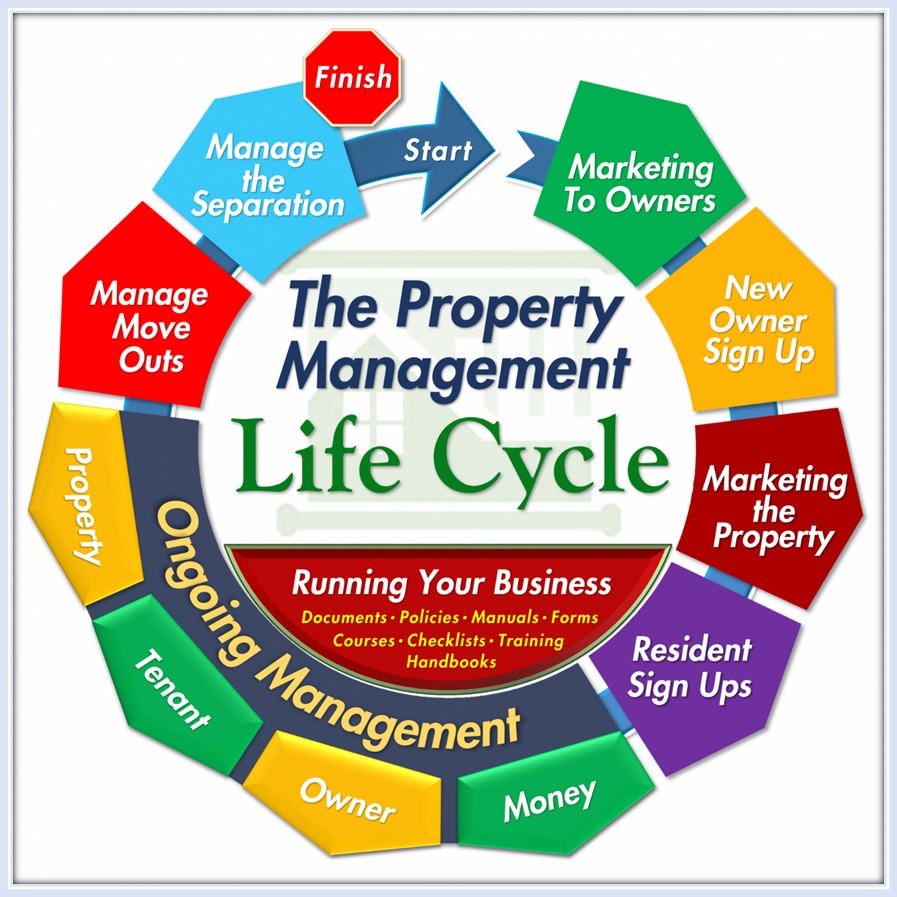

| An Overview of Property Management Processes | You can reduce property management to 10 processes starting with marketing to owners, and ending with owner terminations and Rent Recovery. Basically the entire process of listing, leasing and property management can be reduced and organized into 10 processes. After the overview of ALL these processes we go into detail of signing up new owners and setting up the tenant properly. We’ll dig into the details of marketing for owners through signing up owners (Onboarding) and marketing to tenants through completing the move-in inspection. | $77.00 | ||

| Leasing and the Law | Most people stepping into the world of leasing (or property management) have a real estate license and by default think they can do leasing. After all, how tough can it be? This workshop begins with exposing to licensees just how hard it is to make the shift from sales to leasing and describes why sales brokers historically dislike the idea of having their agents involve themselves in leasing. We’ll start with the many laws that govern leasing that agents didn’t have to study in preparing for their sales careers. These laws are A MUST for agents stepping into the leasing business. Having a license (and a document) DOES NOT qualify you to do leasing even though your real estate commissioner may allow it. Most sales brokers know this instinctively. This is NOT a property management class. It’s about licensees doing leasing. | $77.00 | ||

| Building a Property Management Infrastructure | 2.5 hours of Video Training Here we examine the six building blocks of property management. Surprisingly, every property manager does the same thing, in the same sequence, no matter what part of the country they practice. Everyone does it a little differently but the processes are the same nationwide. This workshop examines the six major building blocks of the management business. We’ll examine the manager’s Scope of Service, Model, Management Style, and build a Tenant Handbook, Owner’s Handbook and define their company’s Job Description. If you want to build a smooth-running profitable management company you must start with these critical building blocks. | $77.00 | ||

| Managing the Property After Move In | 2 hours 41 minutes of Video Training Once the tenant moves in, there are six processes to administrate. This workshop is all about managing the tenant after the move in, through the move out, and separation with the owner. This workshop is down-in-the-weeds as we’ll address day-to-day-tasks of managing the tenant, the money, the property, the owner, the move out and termination of the property/owner. | $77.00 | ||

| Scope of Service Package |

Most owners don’t know what property managers do for the fees they charge resulting in tension between owners and managers over unrealistic expectations. To make this worse, some managers think they are supposed to manage the owner’s utilities, HOA issues, home warranties, insurance issues, tax reporting, property tax issues, property line disputes and basically everything that remotely affects the property. If owners have managers in other parts of the country/world they may come to you expecting you to manage all these things for the monthly fee you quoted them. If you don’t set these expectations and put bookends on the services you offer for the fees you charge, they will bully you into doing things you don’t know how to do, have no experience doing, don’t have the authority to do and are not getting paid for in order to keep your owner happy. Over the years, managing for about 3,000 owners, we’ve fought these battles and, out of necessity, developed several strategies to push back (put bookends on our services), set expectations and let the owner know what we do for the fees we charge and what will cost more if they want additional services. Just to be clear, you can choose to do anything the owner asks you to do and you don’t have to charge for it. You just don’t want the owner to EXPECT IT for the monthly fee you’re receiving. What You Get

| $75.00 | ||

| CYA from Owners Package # 3 | Buy Package #3: New Owner Sign Up-Entity Documents (use them when appropriate) which includes documents 19-21. The price for buying each document individually would total $90.00 or you can purchase the complete package for $70.00 (Subscribers get another 20% off all Document Packages). We spent thousands of dollars developing these documents. You can have them for pennies on the dollar. 19. Certification of Trust; 20. Corporate Resolution; 21. Limited Liability Company Affidavit | $70.00 | ||

| PMA Module # 7 How to Get Owners to Embrace your New Management Agreement |

Your cover letter, asking your current owners to execute and return your new agreement, is critical. Current owners will be suspicious and many will read it carefully. As we’ve helped managers do this over the past 15 years we’ve discovered eight ways to approach it. This package of documents and training videos will outline eight different strategies you might use to approach your current owners. We’ll address “when” to send them out, “how to respond to questions”, “how to deal with large or multiple family owners’ and other tips you’ll want to consider before you send out your new agreement. Do this just right and you’ll keep your current owners. Do it badly and you’ll lose some of them and create unnecessary chaos. What you get in Module #7Eight strategies (and draft letters) to choose from for best results. Training videos addressing exactly how and when to send them out and how to respond to questions. Because we’ve done this for other managers 60+ times we can help you avoid some of the mistakes we’ve seen. These documents were created and tweaked by attorney Monica Gilroy and Robert Locke RMP, MPM and are usable in all states. Since you don’t sign them they are simply a Housekeeping Document. Always run legal documents by your local attorney before you use them. | $65.00 | ||

| PMA Module # 3 Housekeeping Documents |

To keep the PMA short, easy to get the owner to sign, and easy to defend in court you must keep all operational issues out of it. By including only legal issues you can shorten the agreement to six pages and make it easy to defend. However, there are some critical operational issues you’ll want every owner to understand and embrace during the onboarding process to protect yourself and prevent future litigation. For two decades Monica called these “Housekeeping Documents”. These documents are initiated by the owner to make sure they’ve read them and embraced them, yet, are not attached to the PMA (as an exhibit) from a contractual perspective. The protection for you is … you don’t sign them. Only the owner signs them so they are NOT part of the PMA or an exhibit or addendum. Yet, if there is litigation, they carry a ton of credibility in the courtroom. The language in them doesn’t need to clutter up the PMA document, yet, just above the owner’s signature it says “I’ve read this and agree to embrace it while under management with XXXXXXXXXX.” Like a lead-based paint disclosure they are simply housekeeping documents and expand on the legal protections already in the PMA. At Crown, over the last two decades, we developed our Housekeeping Documents and have them in word format in this download (View the list). Your model is obviously different from ours so your final bundle of Housekeeping Documents will be different than ours. Your experience will make you hypersensitive to issues we’ve had no experience with like show removal, solar panels and pools. You’ll add and subtract to these documents over time as your model requires. The key reason you don’t want them tied to your PMA is ‘operation issues change frequently.’ You want a PMA that won’t need changes for many years to come yet have Housekeeping Documents you can change as you get smarter and things change in the business. The message is ‘stop tweaking your PMA’ and set yourself up to change operational issues whenever you like without cluttering up the PMA with minutiae. Note: One of the benefits of using Housekeeping Documents is you can address fees and costs in them without having to clutter up the PMA. You get to spread out the fees by using this Housekeeping Documents strategy. Remember: you are not required to disclose all fees in the PMA. You are simply required to disclose them. It can be done in a Housekeeping Document because THEY acknowledge that document with their initials and therefore acknowledge the fees disclosed in that document. What you get in Module #3

These documents were drafted, and been tweaked, by attorney Monica Gilroy and Robert Locke RMP, MPM and are usable in all states primarily because they are not legal documents. Since you don’t sign them they are simply Housekeeping Documents the owner initials. Always run legal documents by your local attorney before you use them. | $65.00 | ||

| PMA Module # 2 Video Library |

Robert and Monica shot over two dozen training videos to help managers grasp the essential strategies of this customized management agreement. This is an essential part of the managers training on building and managing this vital document. There are many elements of managing owners well and it’s hard to put it all in the management document (Module #1) itself. Two primary motives drive these training videos: Generating profits and protecting yourself from the natural liabilities that come with this business.Watch a sample video here What you get in Module #2Over two dozen studio-shot training videos (7 to 9 minutes each) covering every detail of the management agreement language and strategy. This makes great training for both you and your staff so you’re not doing it all yourself. View library of video titles. | $65.00 | ||

| Broad Standing Disclosure | The property management business is a thin-margin, nickel-dime, service business and managers need lots of different ways to generate revenue to survive, including setting up separate businesses that can support (and profit off of) the management business. We all know that disclosures to our owners is critical to keep your license but often struggle with the question ‘When And How Do I Disclose’ so I can charge fees, receive referral checks, take commissions, make spreads, profit on maintenance, markup ancillary services and make money through outside companies I own. The question is, “what do I say in the PMA (that owners will accept) that permits me to make this additional revenue … and, how can I word it so the owner doesn’t get mad, or the real estate commission come down on me for not disclosing properly? We struggled with this for years and tried lots of different methods of disclosure that met these three criteria. In the mid 90’s, with attorney Monica Gilroys help, we finally settled with this language. Owners feel it’s reasonable and fair; it opens up the floodgates of new revenue streams, and, it satisfies the real estate commission's requirements of Full Disclosure. It’s called a Broad Standing Disclosure. | Original price was: $145.00.$65.00Current price is: $65.00. | ||

| CYA from Tenants Package # 1 | Resident Sign Up Application Documents (use when qualifying residents) which includes documents 1-4. The price for buying each document individually would total $71.00, or you can purchase the complete package for $62.00 . | $62.00 | ||

| PMA Module # 4 Ancillary Documents |

While all the Housekeeping Documents are signed by every owner every time, “Ancillary Documents” are only used when necessary and appropriate. A pool document isn’t needed all the time. A hot tub disclosure, multiple owner agreement, HOA disclosure, sprinkler system or security system disclosure is only needed when it’s appropriate. If you attempt to address all these possibilities all the time your PMA becomes grosely over written and a burden to manage as changes are frequently needed. We have a list of documents we developed for the owner but you’ll add more as your model requires. This download will give you a good start. These documents were created and tweaked by attorney Monica Gilroy and Robert Locke RMP, MPM and are usable in all states. Since you don’t sign them they are simply a Housekeeping Document. Always run legal documents by your local attorney before you use them. What you get in Module #4 | $55.00 | ||

| Asset Manager vs Property Manager (Scope of Services) | Some owners think you should manage everything that remotely touches their property. Most have never owned a rental property and have no idea what property managers do. If you don’t manage their expectations they will instinctively ask you to manage mortgage issues, utilities, home warranties, set up bank accounts, file foreign tax compliance forms, manage HOA issues, insurance claims and whatever else needs to be done, in addition to managing the tenant and maintenance. That’s a perfect definition of an asset manager but most owners don’t know the difference and neither do most property managers. Often, large asset managers (or foreign investors) will ask you to set budgets, estimate NOI, get bids on insurance coverages, manage the code enforcement officer, manage property tax disputes, oversee insurance claims and a whole host of other duties you’re not trained to (or have the experience to) manage. To make it worse, you’re not being paid to do all that stuff for the lousy $70 a month management fee. Private owners sometimes have the same ideas and need help understanding what you do for the fees they pay you or, better yet, what you don’t do. If you don’t define it, they will, and often their expectations are off the chart and totally unacceptable. If you don’t have a way to explain the limits of your services there will be tension between you and your client as you attempt to quell their unrealistic expectations as they come up. Defining the difference between an asset manager and a property manager is a great way to address the issue. Managers need a document to send their owners (or make it part of their new owner sign up package) that identifies the differences. Over the years we developed a document differentiating one from the other so the owner can get their heads around what you do and don’t do for your fees. It’s a editable document so you can add your company name, tweak it to your model and publish it. | $55.00 | ||

| Third Party Relationships (Scope of Services) | This document package includes language for your PMA, a training and support document for your staff and a document for your owners to explain why you can’t take over their previously created third-party relationships. Owners often think (because they just don’t know any better) that you’ll take over third-party relationships they’ve developed before they came to your door including mortgage payments, paying HOA dues, manage utilities, HOA violations, home warranties, property line disputes, insurance claims, code enforcer, property tax disputes and more. If you don’t make it clear up front, you’ll get bullied into managing relationships THEY forged and relationships you weren’t a party to and stepping in and managing them will suck up a lot of your time and energy. This language and support document will solve that challenge for you and make your life much easier. | $55.00 | ||

| 2 Hour Training Video on Guidelines in Manual | In this ‘studio shot training video’ we work through the Full Version of the qualifying guidelines one topic at a time. It’s arduous but any staff you’re trying to train for this process needs to hear the details .. maybe more than once. When training someone to do qualifying applicants they need this training and you protect yourself when you can say … “we were trained on this by our broker.” Real Estate commissioner's, owner’s and HUD love to see that you’ve done lots of training for this process. | $55.00 | ||

| Third Party Relationships | When owners connect with property managers they bring preexisting relationships with them (third parties they have already established a relationship with where the owner is the customer). Examples might include relationships like mortgage companies, insurance carriers, pest control companies, weed control providers, HOA relationships, builder/home/appliance warranties, tax assessors, code enforcement officers, and many more. The problem is, the owner doesn’t know that you can’t take over those relationships because they are the owner’s pre-existing third party relationship. Owners love to bully managers into taking on the management of those relationships because they are time consuming and often aggravating to deal with. They naturally think you are supposed to pick up the management of these relationships. After all, aren’t you the property manager? Isn’t that what they are paying for? They aren’t being mean, they just don’t know what a property manager does (and doesn’t do) for their fee so you need to educate them. | $55.00 | ||

| Unenforceable Terms in the Lease Disclosure | Owners naturally believe if it’s In the lease, it’s enforceable and will hold it against their manager if not enforced. Owners think you’re the expert and they are paying you to get it right and draft leases that are enforceable. It is incumbent on YOU to get it right and make it legal and enforceable or YOU are going to be blamed if it hits the fan. This product includes the disclosure language to the owner and a training document for the manager and their staff regarding how and when to implement this document. | $47.00 | ||

| Things You Can’t Turn Over to Your Property Manager (Scope of Service) | This is a simple document listing the things that are NOT included in your service package and won’t do as part of your monthly fee. Give this to the owner during the owner signup process (and maybe have them sign it) so they understand upfront that there are several things they must stay engaged with and continue to manage themselves. As we struggled with the owners unrealistic expectations this was the first solution we came up with. It worked well for several years until we got more sophisticated and developed better tools to push-back on this challenge of what are they paying you for anyway? | $47.00 | ||

| PMA Module # 9 How To Keep Owners Out Of Maintenance |

One of the property managers biggest challenges is “keeping owners out of maintenance issues.” Because they own the property they think they should have control over it and then owners try to control maintenance all kinds of bad things happen. In the early years of managing we felt owners needed to be involved with maintenance issues and as we scaled we figured out that their involvement created more chaos than we could stand. Our conclusion was “if we wanted to scale we had to Get Owners Out Of Maintenance.” Solving this challenge took some time, but ultimately we figured it out. What you get in Module #9 These documents were created and tweaked by attorney Monica Gilroy and Robert Locke RMP, MPM and are usable in all states. Since you don’t sign them they are simply a Housekeeping Document. Always run legal documents by your local attorney before you use them. | $45.00 | ||

| PMA Module # 8 How To Use Warranties |

Most managers have some kind of loosely stated warranties for their owners but many do not. Warranties are a great way to “add new benefits to the new management agreement” so current owners will be more likely to embrace it. We’ve put our owner warranties in writing for several decades and they’ve helped us win over and keep owners in our camp. There are rules (conditions) to warranties and if you don’t make those conditions clear you’ll stumble with warranties like we did for our first decade. Once you figured this out they became a great onboarding tool as well as a great way to get current owners to embrace your new management agreement. What you get in Module #8Over the decades we’re tweaked, deleted, revised and added warranties for our owners based on our experience with them. We’ve adopted warranties from other managers and presented them in different formats over the years. This is an evolving strategy and next year it won’t look the same as it will your first time. In this package we’ll receive several warranty formats along with training videos to address the “rules and conditions” for managing warranties. We’ll address “why you’ll not put warranties in your management agreement”, “how to use them to close the deal” and “how to use them to get your current owners to embrace your new management agreement. These documents were created and tweaked by attorney Monica Gilroy and Robert Locke RMP, MPM and are usable in all states. Since you don’t sign them they are simply a Housekeeping Document. Always run legal documents by your local attorney before you use them. | $45.00 | ||

| How to Keep a Tenant 20 Years |

| $35.00 | ||

| Application Summary | In order to stay organized and have a quick reference, it’s a good idea to have an Application Summary you can put on top of all the information you gather when qualifying your applicant. Not only is it a summary of their information, it also summarizes additional information you gather during your process as well as documents the outcome. This is the quick reference version of the qualifying process and gives supervisors a jump start on the file without having to dig through the minutia. This has been developed over 7,000 applications so you don’t have to tweak it much. | $35.00 | ||

| Dispute Resolution and Non-Disparaging Agreement |

STOP BAD INTERNET REVIEWS FOREVER with this Dispute Resolution and Non-Disparaging Agreement Package. There are FIVE Documents and THREE Training Videos

| Original price was: $195.00.$35.00Current price is: $35.00. | ||

| Home Warranty Disclosure and Agreement | We’ve all figured out that a home warranty is the curse to the property manager and yet owners still come to us with these already in place. What to do? When you discover one you need a document explaining how you manage home warranties and warn the owner that they can’t just pass them on to their property manager. Since THEY are the customer to the warranty company you need a disclosure document making it clear who’s doing what when it comes to communicating with the warranty company and how the warranty makes managing so much more difficult. When they insist on YOU managing it, you’ll need a limited power of attorney for them to execute so you have complete authority to manage the warranty claims while managing the property, AND the charges you’ll make when you have to manage the claims. This is a VERY BIG CYA issue and will naturally create lots of chaos so be sure you have the tools to manage it properly and profitably. | $31.00 | ||

| Home Warranty Disclosure and Agreement | We’ve all figured out that a home warranty is the curse to the property manager and yet owners still come to us with these already in place. What to do? When you discover one you need a document explaining how you manage home warranties and warn the owner that they can’t just pass them on to their property manager. Since THEY are the customer to the warranty company you need a disclosure document making it clear who’s doing what when it comes to communicating with the warranty company and how the warranty makes managing so much more difficult. When they insist on YOU managing it, you’ll need a limited power of attorney for them to execute so you have complete authority to manage the warranty claims while managing the property, AND the charges you’ll make when you have to manage the claims. This is a VERY BIG CYA issue and will naturally create lots of chaos so be sure you have the tools to manage it properly and profitably. | $31.00 | ||

| Certification of Trust | For asset protection purposes many owners will title their property into a trust. When you see this in the tax records, or on the title page of their deed, you need to remember ‘an individual’s signature on your management agreement is not adequate documentation.’ You can be accused of malpractice or incompetence if you don’t get the listing/management agreement right. Claims from someone that “I’m the real owner behind the scenes, take your instructions from me” isn’t good enough when the title is in an entity or trust. It’s your job to ‘get it right’ and there is no closing attorney to look over your shoulder protecting you from documentation errors or fraud. You need a Certification of Trust, with a signature, witness and notary for your file to protect yourself when things go south and you have an issue with an owner or tenant. Make sure you’re dealing with the right person, with the right authority, and sending the money to the right account before you take on the property titled in a trust. There’s a lot of money at stake and people get real mad when it goes to the wrong account. Make them fill out this certification and swear, in front of a notary, they are the person you can trust for ownership decisions for the trust. | $30.00 | ||

| Special Application CYA Language (to be added to your rental application signature page) | Protecting yourself from tenants starts with including some precise disclosure language in the rental application. Tenants must be told that you intend to investigate their background and may include residency, employment, military, government databases, personal and professional references, social media, character, records of attendance and earned degrees or certificates and more. You need to be point-blank and tell them that by executing the application they are authorizing you to not only check out the information they give you, but share said information to third parties you work with that have a legitimate right to it, plus, contribute to those databases your experience with the tenant. You must protect yourself. You need to cover yourself on many issues before the tenant moves in, during their stay and after they move out. The consumer protection laws (Fair Credit Reporting Act) are designed to protect consumers (tenants) with regard to who has access to their information, as well as who we (the property manager) can share that information with. If you don’t get the tenant’s authorization to investigate (and pass on) their personal information you’ll expose yourself to both FCRA claims as well as civil claims for damages and attorney fees. You must protect yourself. Once they’ve completed the application it’s impossible to go back and ask them to execute this special protection language so this language needs to be on the last page of the application, just before their signature line. Note: In 2016 I was hired by the Atlanta law firm of Weissman Nowack Curry & Wilco as an expert witness in a federal discrimination case against a local property manager with this kind of language in their application. Because they protected themselves with language like this, it will be easy to get him off the hook in the claim as long as their practices match their qualifying guidelines. | $28.00 | ||

| Entity Declaration and Data Schedule | Investors often hold title in a land trust, limited liability company, family limited partnership or a corporation camouflaging who the real owner is behind the curtain. It’s not safe just to take them at their word as some are wiley and will trick you as to who the true owner really is. Properly identifying who the actual owner is (or who has authority to sign for the entity) is often a challenge for a property manager. Closing attorneys are good at this but generally you don’t have one to help you figure it out. Before you begin managing the property held in some entity, you need clarification. This document helps clarify ownership and who is authorized to execute documents and receive money on behalf of the entity. | $27.00 | ||

| Managing Litigation in Property Management -- Breakout | Property Management is the least paying job within the real estate industry, but the job where you are most likely to get sued. Even lawyers stay clear of our industry because there is so much work for them with so little reward. Robert Locke in Orlando offered the national NARPM conference a proven set of strategies for limiting litigation. The event was taken and reworked within the studio for those who could not be at the event. This video series will resource your employees and office leadership to create policies and set procedures to mitigate litigation which is robbing your company of the joy and profits which are possible in property management. | $27.00 | ||

| HOA Disclosure | Owners will forget to tell you about HOA requirements and restrictions regarding leasing in their managed communities. This document has been created in 1996 due to the ever increasing dangers we faced leasing in aggressive HOA-managed communities. Owners forget to tell managers about special signage requirements, special forms the tenant needs to sign, special permits needed to lease in the community and these issues can get managers in all sorts of fistfights. HOA’s are booting tires when dues are not paid, dismantling entry keys to pools and evicting tenants over continuous rule violations and managers need to protect themselves from these HOA (or owner caused) hazards. Managers are getting sued by tenants over loss of right to quiet enjoyment, wrongful dispossessory, harassment and constructive eviction when the HOA’s begins to bare down on them. Managers need a document to protect themselves when owners forget to disclose the presence of an aggressive HOA and the requirements of tenant rules in the community. (You also need to have the tenant sign a document preventing them from suing you if the HOA does them wrong. See our Tenant CYA section for a list of documents to protect yourself in these situations). This is one of the most toxic and litigious battle ground of management exposure in today’s rental market and owners need to notify (and indemnify) managers for the fallout from these issues. HOA’s have hugh power over the owner, and ultimately you, regarding what happens in their communities and they love to wield it without mercy. Don’t get caught up in the fines, assessments and debates without having this protection from the owner. | $24.00 | ||

| Owner’s Mortgage Disclosure | One of the huge risks managers bare today is renting a property, move the family in, then watching as it goes into foreclosure and the tenant gets evicted by the lender. We’ve had it happen more than we’d like to admit. If you don’t protect yourself you will get sued by the tenant for violation of your promise of quiet enjoyment, unlawful dispossessory or constructive eviction. When the owner signs this document they are promising the mortgage is current; if it goes into foreclosure they will notify you immediately (not that it will help any), and (here is the big one) they will pay your attorney fees if you get sued by the tenant over the foreclosure issues. Don’t make the mistake of thinking, “if the owner loses the home in a foreclosure they won’t have any money to defend you, so why go through the effort.” Wrong!!! Many landlords have great credit, own their own home, have good paying jobs and will still let their rentals go into foreclosure. Don’t think they are broke just because they let the rental go back to the bank. Having them defend you is good protection and they will sign this without question if they think they will not be foreclosed on. If they hesitate signing this you should be suspicious and do more research. Get this signed up front and protect yourself from the carnage of a foreclosure. | $24.00 | ||

| Personal Property Disclaimer | Owners love to leave personal property behind thinking it will still be there when they return. It seldom is and guess who they want to hold responsible for protecting and managing it? YOU of course. No matter what you say to them, they think you should be the guardian of their stuff, and see to it that it gets returned in good shape. Protect yourself. Take yourself off the hook in advance and make it clear ‘you’re not the manager of their personal property.’ For years we tried to accomplish this with a stip in the management agreement but it didn’t work. You need to draw their special attention to this Issue and this document accomplishes that. This document tells them to take their personal property out or don’t expect to see it ever again. They will leave stuff locked in a closet in the basement and expect you to manage it as well. They will expect you to manage the water leaks and mold on their stuff in their Owner’s Closet and blame you when the rodents find their way in. Make it clear you’ll list items they leave behind but they can’t hold you accountable when it turns up missing or broken. | $24.00 | ||

| Cosigner Agreement | We got a lot of cosigner guarantors because a) we asked for them, and b) because they added backup to the applicant’s promise to fulfill the terms of the lease. We found collecting from the cosigner after move out was often easier than collecting from the tenant who left owing a balance. Often we got an employer, parent, sweetheart, partner or relative to back the applicant and agree that if they left owing money, the co-signer would make good on their promise. It’s amazing how a threatening letter or two wakes them up and they pay the bill left behind by the tenant. Owners are grateful when you do a great job for them and are pleased when they see you go the extra mile to protect them. | $23.00 | ||

| Roommate Addendum | When three applicants want to move in together make sure you get them on a separate document outlining your requirements for roommates. You’ll need to give them some instructions that only relate to roommates, some rules for paying rent, some limits for changing out roommates and more. You’ll disclose the right to go after the one with highest credit no matter who damaged the property and left owing money. Make it known up front how you’ll respond to requests to remove someone from the lease. Roommates love each other when they move in (and will sign just about anything) but, like other community efforts, they often fall out of love and make a mess of the landlord-tenant relationship. | $23.00 | ||

| Guarantee of Payment (Cosigner Agreement) | For one reason or another we often ask for the tenant to find someone to stand with them on the lease. You’re looking out for your owner and adding security to the lease. When there is a co-signor you need a document for them to sign promising to pay what the tenant left owing when they vacate. This is their personal guarantee for the tenant’s obligations under the lease. We get co-signors on about 20% of our leases and it works like a charm. Don’t reinvent the wheel. Let our mistakes make it easier for you. You can figure this out on your own, develop a document and tweak it over time, or have it today. | $23.00 | ||

| Things You Can’t Turn Over to Your Property Manager | Many owners think you are their asset Manager and should take care of everything that has anything to do with their property. You need to make it clear that there are things you can’t (and shouldn’t) take charge of including things like their mortgage, insurance, HOA, utilities, Home Warranties and more. Make it clear up front that you are the property manager and what that doesn’t include. You will eliminate confusion and improve communication if you make this clear before you take on their property. This document begins the process of limiting what the owner expects you to do for your fees. Owner’s love to ask you to manage their HOA’s, Home Warranties, Utilities and more. If you don’t begin this push-back ‘up front’ to put a limit on these requests or demands, you’ll fight with the owner on exactly what it is you do for the fees they pay. They love to ask, “what am I paying you for anyway” meaning ‘you should manage everything that remotely touches their property.’ This document begins that ‘limiting’ discussion. (This is a shorter version of the document posted above called Asset Manager vs Property Manager) | $23.00 | ||

| Homeowner Association Agreement | This is a big CYA document. If the HOA does something drastic like booting the tenant’s car, disconnect the water, sue the tenant for rent because the owner hasn’t paid his dues or threatened to evict the tenant you need to be protected from litigation. The owner will ignore the HOA to get it leased and you’ll deal with the battles when the HOA wakes up to the reality that there is a new tenant in the community. You want the tenant holding you harmless when the HOA can’t open the pool or tennis courts because not enough owners have paid their dues. You need to protect yourself against the possibility of being sued for constructive eviction, wrongful dispossessory, loss of quiet enjoyment or harassment by the HOA. Tenants want to blame the property manager for everything no matter whose fault it is. If the owner fails to keep current with the HOA it can create chaos between you and the tenant so prevent it with this document and protect yourself. | $22.00 | ||

| Multiple Owner Declaration and Data Schedule (Exhibit) | Most management agreements are not set up for four or five owners to sign. When you are dealing with multiple owners you need a way of identifying each of them and more importantly, who the contact person is for you. If you don’t have a spokesperson, you’ll create chaos figuring out who to listen to as they argue about who’s in control. Properly identifying who is on title (or who has authority to speak for the owners) is often a challenge for a property manager. Before you attempt to manage a property with multiple owners, be sure to get all their information and some identification as to who the spokesperson is. This document helps clarify multiple ownership and who’s speaking for the owner(s). | $21.00 | ||

| Official Notice of Approval - QG | When applicants are approved you’ll need a document to lock them down and make sure they follow through with the move in (or lose their money). Some managers have the tenant execute the lease immediately after approving but that may cause some challenges; especially if they read it and make a fuss over something they don’t like. You need to have some kind of enforceable document that lets the applicant know they are approved and lays out the money issues and critical dates. This document identifies the start date, move-in date, rent, deposits, fees, utility companies and other critical data for their occupancy. It puts their deposit at risk and identifies what happens if they change their mind. If you get the lease signed immediately you probably don’t need this. We prefer to hold the lease back but we get them committed as soon as they are approved. This document does just that. | $21.00 | ||

| Security Deposit Promissory Note | We tried many times to add a special stipulation for security deposit installments but couldn’t get judges to enforce it. The note was the answer as judges understand promissory notes. We often get more than one month’s rent as a security deposit. Depending on their credit, we will agree to take installments on a portion of that deposit. We did it poorly for many years and struggled with getting judges to enforce our documents. We finally went to our attorney and paid to get it right. Now we are able to enforce this document and evict for failure to pay as agreed. It’s not 100% but we are successful 85% of the time. Taking installments on the deposit probably needs the owner’s approval depending on your model. | $21.00 | ||

| Built to Scale Training Video Series |

Receive a Continuing Video Series via Email Meet Your Experts:

Coming Soon: | $20.00 / month | ||

| Cashing In Training Video Series |

Receive a Continuing Video Series via Email ✔️ Unlock multiple revenue streams Meet Your Experts:

Coming Soon: | $20.00 / month | ||

| Limiting Smoking in the Lease | Owners frequently want you to put a ‘non smoking stipulation’ in the lease to prevent tenants from stinking up their property. Managers have learned ‘you never to add a stipulation to a lease you have no system in place to monitor it and really can’t enforce,’ and a non-smoking stipulation is one of them. If the owner insists, you need to have them sign a disclosure that although you’ll accommodate them and add it to the lease, there is no way to enforce it. Make sure they don’t have a case against you for failure to enforce a lease that You Can’t Enforce, when the tenant violates the stipulation and leaves smoke smells throughout the property. This provides a way to give them what they want but protect yourself when it doesn’t work. | $20.00 | ||

| Property Features | You’ll need a form for the owner to describe all the features of their property including number of bedrooms, baths, schools, community amenities, which appliances are included, utilities included and other features. Don’t let them ‘push this off on you.’ If there is an error they will blame YOU and THEY should have the information in THEIR files. Often you’ll advertise a property with a washer/dryer and the owner will take it, leaving you to buy one for the tenant (or other crazy things like this). We’ve made the mistake many times of identifying the wrong schools, listing the microwave when the owner takes them, forgetting that the security system was the tenant's expense and so on. There are lots of ways to screw this up so make the owner complete it. There is more than one way to do this. This format is sufficient for most rental houses but will need to be tweaked by you to fit your model. | $20.00 | ||